If you have enjoyed a massive rise in sales over the last 18 months, like many others in adult, you might think that the future looks even brighter. However, this might not be the case — due to potential inflation. The rising price of goods and services in the economy results in a decrease in the purchasing power of money.

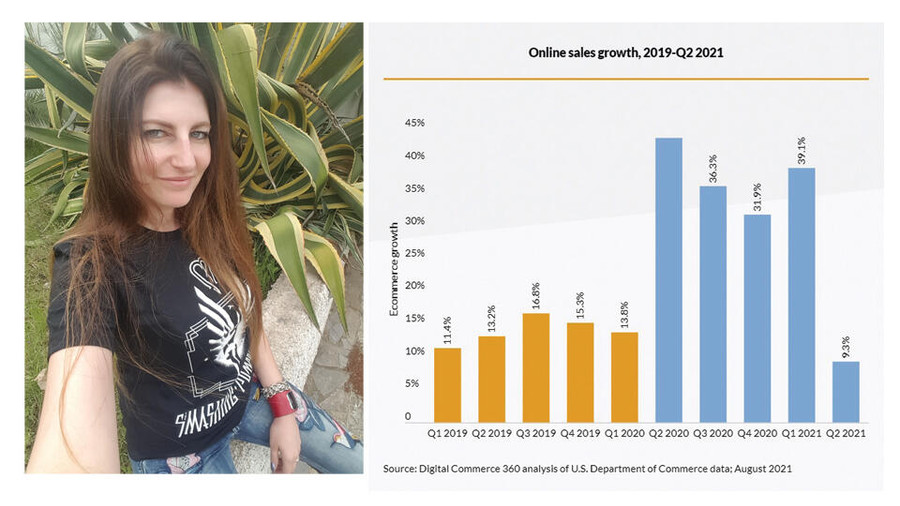

That being said, ecommerce accelerated very quickly from its already impressive pandemic levels as consumers ventured online during COVID-19, to even more rapid growth in the wake of the pandemic. In fact, online sales went up 32% in the U.S. in 2020, the highest annual growth of any year for which data is available.

With consumers changing their buying habits, it is imperative that we change our business habits to protect our earnings from stormy horizons.

ECOMMERCE SLOWING FROM PANDEMIC HIGHS

Figures from Q1 2021 show that the coronavirus was still fueling online spending, with sales surging 39% year over year in that quarter. The statistics from Q2 2021, however, are a different story and show ecommerce growth slowing significantly. Part of that, of course, is due to folks returning to in-person purchasing.

INFLATION IS CHANGING CONSUMER BEHAVIOR

Considering that the most significant rise in inflation since 2008 is now seemingly impacting online shopping, things might even get worse. Increased prices, both offline and online, shift consumers’ buying priorities. A survey conducted in September by consumer research platform Suzy Inc. finds that 45% of consumers are changing their buying habits due to inflation and think inflation will impact their online spending.

One sure thing is that inflation will negatively affect everybody's net earnings as the cost of living increases. This will affect not only our own expenses, but our earnings too, given fans will have less money in their pockets and will be forced to prioritize their spending.

BUNDLINGS GOOD FOR TOP VALUE

Bundle up content or sell it alongside other services you offer, such as Snapchat or dick ratings. Add a 30-second personalized thank-you message to your custom videos, or add one or two bonus minutes to make your fans feel extra special. Plus, fans who have made a purchase from you are more likely to do so again versus those that haven't. Offering those fans a substantially discounted one-year subscription may thus end up being a great investment for them. You get covered for the time ahead and they get a great deal.

DIVERSIFYING AND RECYCLING CONTENT

It has been said repeatedly, but now it's time to take this suggestion seriously: expand your presence online and spread your content across many different platforms. Yes, it is extra work and no, it doesn't require as much time as you’d think.

You don't need to curate your presence on every platform equally, but it is vital, even while you focus on your favorite ones, that you still maintain presence on as many others as possible. This generates passive income, which in the worst-case scenario will cover some of your business expenses. It also generates more business prospects, and if one platform closes or doesn't work for you anymore, you have a ready alternative.

It takes one or two hours to create a profile on a new platform, set it up, and upload four to six pieces of content to get it going. After this initial time investment, you just need to add a weekly post on each of those secondary platforms to remain active and decently relevant. You can even use the same content for all of those platforms.

Suppose you are willing to focus on long-term rather than short-term revenue. In that case, you may consider setting your profile as free-to-view where allowed, thus building up followers who may seek you elsewhere.

KEEPING AN EYE ON YOUR EXPENSES

When the future ahead looks uncertain, it's time to keep an eye on expenses. Limit your spending on unnecessary personal items and save your money, while maintaining a reasonable quality of life. In other words, find the right balance between reducing expenditures and keeping yourself reasonably happy and mentally healthy.

Business-wise, think ahead: demand-pull inflation is the upward pressure on prices that follows a shortage in supply where too much money is chasing too few goods. If you reckon that you need business gear now or will very soon, and you see a reasonable offer, grab it immediately. This is especially true for PC components and other electronics.

For example, back in January I decided to hold off on upgrading my editing equipment until the summer, but that was a mistake because I ended up spending a whole lot more as prices went up higher than expected.

Another way to save is on your energy bill. With a bit of attention, you can save hundreds of dollars in a year just by shutting down computers rather than leaving them in sleep mode, using only low-energy lighting fixtures in your house, switching lights off whenever you don't need them, unplugging your phone from the charger when it’s not necessary and limiting your thermostat use — especially when you’re not home.

TACKLING CHARGEBACKS

Our industry has always been particularly subject to chargebacks, which are forced payment reversals initiated by a cardholder’s bank when they dispute a purchase — even if there is no merit to their complaint. With inflation on the rise and a possible recession on the horizon, it's just good, cautious common sense to expect that more people who pay to access your content will ask for their money back.

This scenario is not just bad for income streams that come from platforms that do not cover chargebacks, but also for your account status on those that do, as a high percentage of chargebacks vs. sales can result in you being banned.

So, make an effort to know your customers. A few content platforms out there offer anonymous ratings systems to judge fans, which can help you decide if a potential new client is worth doing business with. In any case, always provide relevant product and service descriptions on your goods, be clear on delivery details — even digital content — and always keep a line of communication open with your clients to promptly address any potential issues.

PREPARING FOR THE WORST, HOPING FOR THE BEST

Mind you, nobody can truly predict the economy, so inflation may end up not being a huge factor in the future after all. There is also no perfect recipe for facing and surviving inflation or a recession when they do come, though it's clear that limiting spending and putting more into savings is a smart thing to do. But even though the future could potentially be brighter, as performers and creators, it’s always wise to hope for the best but plan for the worst.

Sabrina Deep is Blisss.company brand manager and ambassador. She can be followed @SabrinaDeep on Twitter and contacted by email at Sabrina@Blisss.Company.